OneView: The convenient agent interface

for your employees

BANCOS Onboarding combines a high degree of automation with transparency. This is because in daily business, even in the context of highly automated processes, important decisions or checks are made that require manual handling. For this purpose, BANCOS Onboarding integrates the convenient agent interface “OneView” that covers these functions:

- Access to all customer, product and contract data as well as to all data on the course of the decision-making process to date

- Possibility to add/correct information and data depending on the application step

- Overview of all processes still to be processed for easy prioritization of tasks

- Integrated role and authorization concept

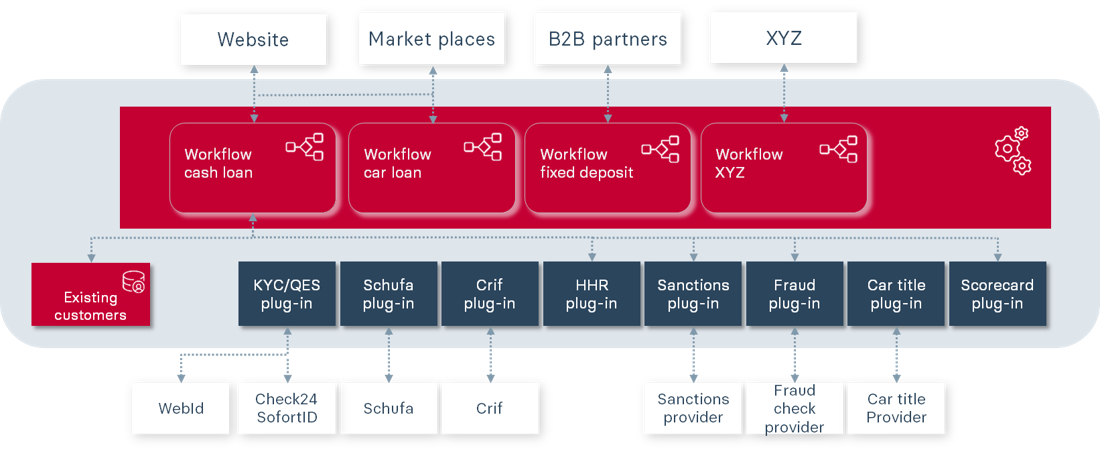

Seamless and rapid integration of third-party services

Our plugin repository contains for example ready-to-use modules for Digital Account Checks (DAC), Know Your Customer (KYC) verification, Qualified Electronic Signatures (QES), and credit bureau integrations. Each plugin is designed for seamless integration with your existing systems, significantly reducing development time while ensuring full compliance with regulatory requirements.

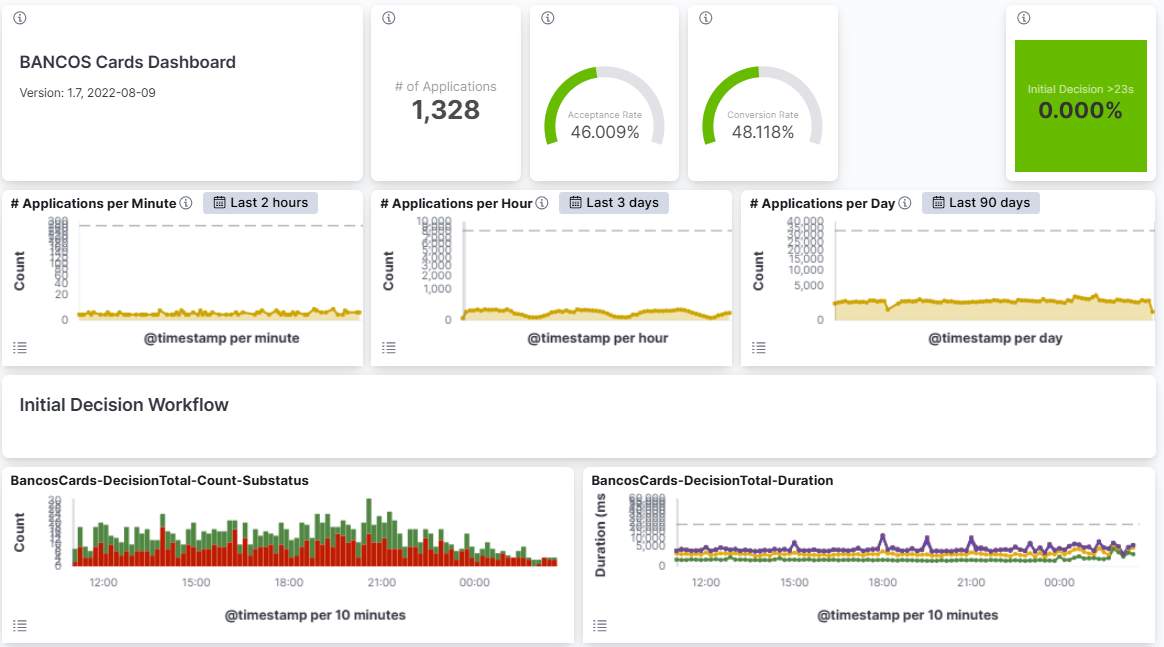

Process control and optimization via monitoring dashboards

BANCOS’ controlling and visualization solutions provide real-time insights so that you can draw specific conclusions for process optimization from operational data. The integrated dashboards and monitoring tools create the necessary transparency for bottlenecks and processes.

Our dashboards for processes such as loan applications visualize them at every stage. This enables data-driven decisions on resource allocation and process improvements, transforming operational metrics into tangible benefits that positively impact your bottom line.

Schedule your personal consultation

Discuss your situation with us, as well as the application possibilities, features, and technical details of our software—we would be glad to provide a personalized demo.